No Income Tax Up to ₹12 Lakh: Government’s Masterstroke for the Middle Class.

A major idea of India’s latest tax reform is making income up to ₹12 lakh tax-free under a new regime that is sure to transform the lives of millions of salaried people and middle-class families. This announcement in the Union Budget 2025-26 also simplifies the taxation burden by increasing disposable incomes. Salaried taxpayers get zero tax even up to ₹12.75 lakh after standard deduction.

New Tax Regime Details

As of FY 2025-26, a new structure of income tax has been introduced as default-tax slabs. Accordingly, these slabs are: The first ₹0-4 lakhs, which is charged at a rate of 0% The next ₹4-8 lakhs, which is charged at a rate of 5% The next ₹8-12 lakhs, which is charged at a rate of 10% The next ₹12-16 lakhs, which is charged at a rate of 15

One important tax saving in this regard would be the expanded tax rebate under Section 87A, entitling a completely exempt tax liability for a gross total income of ₹12 lakhs. For the salary earning classes, the standard deduction of ₹75,000 is an important aspect in lowering the taxable income to result in a zero tax liability for ₹12.75 lakhs. The new taxation regime has done away with all major deductions, but with the lower rates, an encouragement for taxation by the citizens is an important aspect. https://www.pib.gov.in/indexd.aspx?reg=3&lang=2

These taxpayers who have no business income qualify for the benefit of a tax exemption scheme. Thus, it can well be observed that the intention to move for such an amendment is nothing but to keep more money with the citizens to be spent.

Comparison with the Previous Scheme.

The prior new regime (pre-Budget 2025) had slabs starting at 0% up to ₹3 lakh, 5% for ₹3-7 lakh (later ₹3-10 lakh in some updates), rising to 30% above ₹15 lakh, with a rebate of up to ₹7 lakh. Zero tax is applied only up to roughly ₹7-8 lakh after rebate.

Old regime slabs remain unchanged: 0% up to ₹2.5 lakh (<60 years), 5% for ₹2.5-5 lakh, 20% for ₹5-10 lakh, 30% above ₹10 lakh, plus extensive deductions such as 80C (₹1.5 lakh), HRA, and 80D. Rebate covered up to ₹5 lakh.

| Income Level | Old Regime (Pre-2025, <60 yrs) | Previous New Regime (FY24-25) | New Regime (FY25-26) |

|---|---|---|---|

| ₹0-3L | 0% up to ₹2.5L, 5% after | 0% up to ₹3L | 0% up to ₹4L |

| ₹5L | ~₹12.5k tax (no deductions) | Full rebate (0 tax) | 0 tax https://www.pib.gov.in/indexd.aspx?reg=3&lang=2 |

| ₹10L | ~₹1.12L tax | ~₹50k tax | ~₹45k (pre-rebate) |

| ₹12L | ~₹1.57L tax | ~₹80k tax | 0 tax |

| ₹15L | ~₹2.62L tax | ~₹1.4L tax | ~₹1.25L tax |

| Above ₹24L | 30% + surcharge | 30% from ₹15L | 30% |

New regime saves up to ₹1.14 lakh annually versus prior new slabs, pushing 30% bracket to ₹24 lakh from ₹15 lakh. The old regime suits high-deduction claimants; the new one favours simplicity.

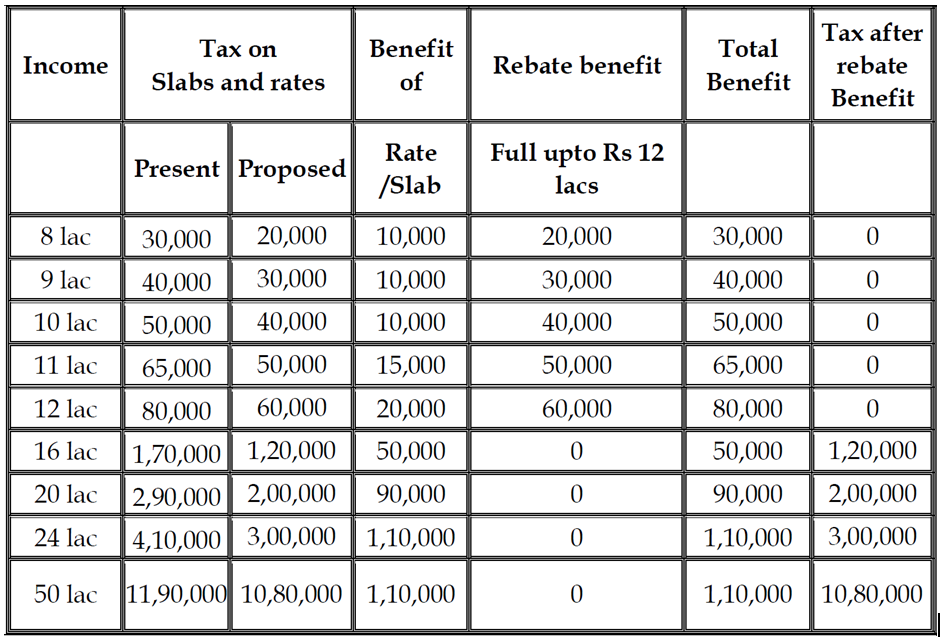

The total tax benefit of slab rate changes and rebate at different income levels can be illustrated in the table below:

Detailed Analysis: Benefits and Impacts

This is a “masterstroke,” aimed at people belonging to the mid-group earners, averaging ₹1L/month, exempting 70-80% taxpayers with salaries. Tax savings: ₹45k-80k for ₹8-12L earners compared with

Economically, it triggers consumption spending (enhancing GDP), formal employment, and reduces evasion due to the simplification of rules. Drawbacks include forgone incentives for savings, such as PPF and ELSS. However, its retention of incentives, like NPS employer contribution (14% for government servants) and standard deduction, is desirable.https://www.pib.gov.in/indexd.aspx?reg=3&lang=2

For Bihar/Jharkhand candidates like BPSC/JPSC aspirants (typically earning ₹5-12L), this provides financial freedom for tuition/coaching &/or books. Female freelancers also benefit as there

Switching logic: Let’s switch if new deductions are less than ₹3-4L; otherwise, stay with old. Those filing ITR-2/3 get a choice.

Who Benefits Most?

- This “masterstroke” targets middle-class earners (avg ₹1L/month), exempting 70-80% of salaried taxpayers from liability. Tax savings: ₹45k-80k for ₹8-12L earners versus the old regime without deductions.Economichttps://www.pib.gov.in/indexd.aspx?reg=3&lang=2ally, it spurs consumption (boosting GDP), encourages formal employment, and cuts evasion by simplifying rules. Critics note lost deduction incentives for savings (PPF, ELSS), potentially hurting long-term investments. Yet, retained perks like NPS employer contribution (14% for govt employees) and standard deduction maintain appeal.

Eligibility and Implementation

The new tax system applies to individuals, HUFs, and AOPs (you can opt out through your ITR). It does not include capital gains or lottery winnings (which are taxed at special rates). File your ITR by July 31st; use the calculator on incometax.gov.in.

Under the new system, the standard deduction is only ₹75,000. There are no HRA/LTA/80C deductions. The updated Form-16 will reflect these changes; the e-filing portal will guide you through the selection process.

Potential Drawbacks

Organised deductions can discourage saving habits; for example, without Section 80C, the inclination towards ELSS would shift towards direct equity. The higher tax slabs (15-25%) in the ₹12-24 lakh bracket after rebates are a deterrent. There is no inflation indexing.

Litigation will certainly decrease, but a public awareness campaign is needed for the changes to be effective.

Final Thoughts for Common People

This taxation reform will benefit 8-10 crore taxpayers, which will add an extra ₹50,000 to ₹1 Lakh in their pockets every year. Calculate using tools, and take opinions from Chartered Accountants for personal preference. Watch Budget 2026 for modifications – file your taxes accordingly